34+ percentage of salary for mortgage

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Dont Settle for Less.

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

With a Low Down Payment Option You Could Buy Your Own Home.

. With a Low Down Payment Option You Could Buy Your Own Home. Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Keep your total monthly debts including your mortgage. With a Low Down Payment Option You Could Buy Your Own Home. Create Your Discharge of Mortgage Form at No Cost.

This calculation is often referred to as the front-end ratio. VA Loan Expertise and Personal Service. Highest Satisfaction for Mortgage Origination.

And you should make. Ad Tired of Renting. Web The Bottom Line.

Or your budget could be smaller. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Ad Request A Personalized Home Insurance Quote That Fits Your Needs.

Why Rent When You Could Own. Why Rent When You Could Own. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Contact a Loan Specialist. Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36. This makes up 253 of their total income based on average annual earnings of 84352 before taxes and 349 of the total household annual expenditure of 61334.

Web On average closing costs are about 34 of the purchase price of your home1 Your lender and real estate agent buddies will let you know exactly how much. Compare Apply Directly Online. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or. With a Low Down Payment Option You Could Buy Your Own Home. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web The latest data shows that the average amount American households spend on housing per month is 1784 or 21409 per year. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Get Great Home Insurance Protection Service and Discounts.

Ad Release from a Lien on the Property. The 36 should include your monthly mortgage payment. As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

Keep your mortgage payment at 28 of your gross monthly income or lower. Completed by You in 5-10 Minutes. Get Your Quote Today.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best. Were not including any expenses in estimating the.

So if your gross monthly income is 8000 your monthly mortgage payment should not exceed 2240. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web The 28 Rule. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Web When all things are considered like your debt down payment and mortgage rate you might find you could borrow as much as 6 or 7 times your salary for a mortgage. Ad Tired of Renting. Apply Online To Enjoy A Service.

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

How Many Times My Salary Can I Borrow For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Your Income Should Go To Your Mortgage Hometap

What Percent Of My Salary Should I Save I Am 30 And Just Started Financial Planning Quora

Percentage Of Income For Mortgage Rocket Mortgage

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

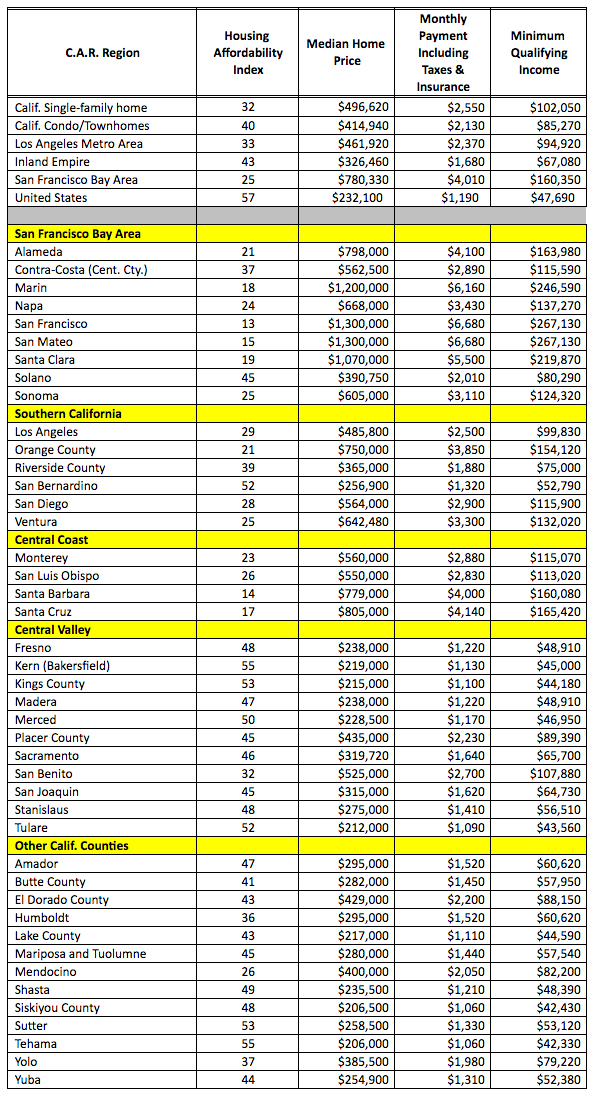

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

How Much House Can I Afford Moneyunder30

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

How Much Mortgage Can I Get For My Salary Martin Co

How Much House Can You Buy For 1 000 Per Month The Homa Files

Sbi Maxgain Home Loan Review With Faq S

Chart Of The Day Mortgage Size Vs Average Wages This Is Money

How Lenders Calculate Your Income Confidence Finance Mortgage Brokers

What Percentage Of Income Should Go To Mortgage

Nationwide Homebuyers Need 34 More Income Or More To Afford A Mortgage Nmp

What Percentage Of Your Income To Spend On A Mortgage